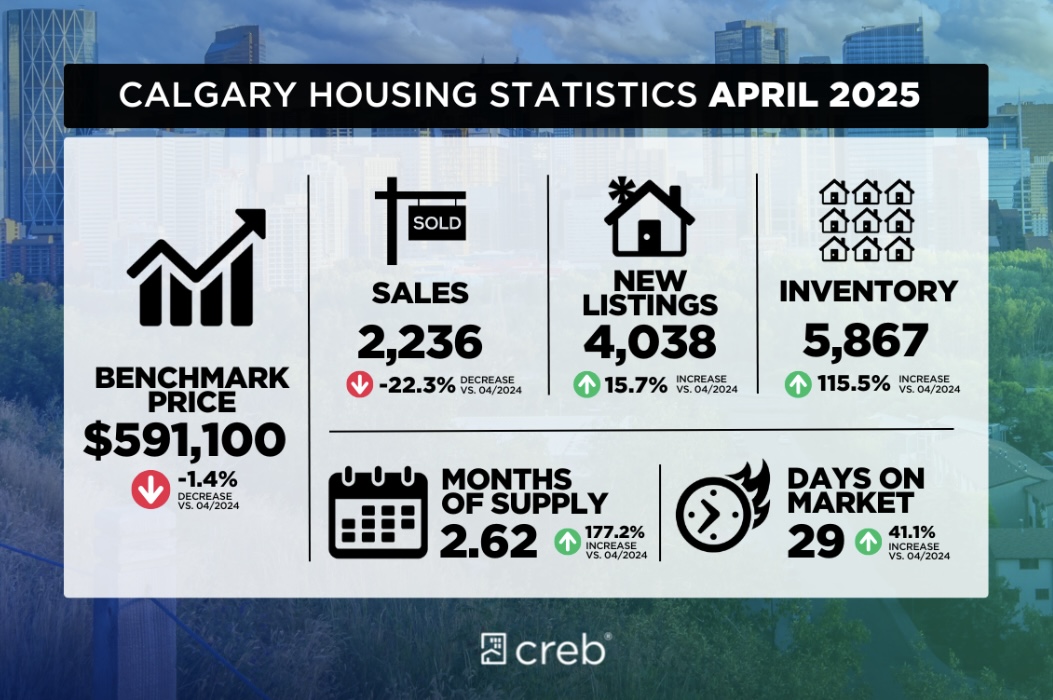

If you’re selling a home in Calgary and noticing strong interest but no offers, you’re not imagining things.

Buyers are hesitating more right now — and it’s showing up in very specific ways.

This doesn’t mean homes aren’t selling.

They are.

But the market has shifted enough that strategy matters more than momentum.

Here’s what Calgary buyers are hesitating on right now — and how sellers can adjust without overcorrecting.

Buyer Hesitation #1: Pricing That Feels Optimistic

Buyers today are extremely price-aware.

They’re:

Comparing listings closely

Watching price reductions

Tracking days on market

When pricing feels even slightly ahead of the market, buyers hesitate — not because they don’t like the home, but because they’re waiting to see if the price adjusts.

How Sellers Can Adjust

Pricing doesn’t need to be aggressive — it needs to be defensible.

That means:

Clear alignment with recent comparable sales

Honest consideration of condition and location

Pricing that answers buyer questions instead of creating them

The goal is to remove doubt early.

Buyer Hesitation #2: Condition That Doesn’t Match the Price

Buyers are more cautious about work right now.

Homes that need updates, repairs, or cosmetic improvements can still sell — but only when the pricing reflects that reality.

Where buyers hesitate is when:

Work is required and pricing assumes perfection

Updates are needed but not acknowledged

Buyers can’t quickly understand the cost vs value

How Sellers Can Adjust

You don’t need to renovate everything.

But you do need to:

Be realistic about what buyers are walking into

Address obvious objections proactively

Price with transparency, not hope

Clarity builds confidence.

Buyer Hesitation #3: Unclear Value

This is one of the biggest — and most overlooked — hesitation points.

Buyers pause when they can’t immediately answer:

“Why this home, at this price, right now?”

This can happen when:

Marketing doesn’t clearly communicate strengths

The buyer profile isn’t obvious

The listing blends in instead of standing out

How Sellers Can Adjust

Value needs to be communicated, not assumed.

That means:

Clear positioning

Strong first impressions

Messaging that speaks directly to the right buyer

Homes that tell a clear story sell faster.

What This Market Is Rewarding Right Now

Calgary buyers aren’t disappearing — they’re becoming more intentional.

Right now, the market rewards:

Clear pricing

Honest condition alignment

Strong positioning

Fewer unanswered questions

Sellers who adjust to this reality are still seeing results.

What This Market Is Not

This is not:

A market where everything needs a price cut

A signal to panic

A reason to pull listings prematurely

It is a market where thoughtful adjustments matter more than ever.

Frequently Asked Questions

Are buyers waiting for prices to drop?

Some are — but many are simply waiting for clarity and alignment.

Should sellers always reduce price if there’s hesitation?

Not always. Sometimes messaging, presentation, or expectations need adjusting first.

Is this hesitation permanent?

No. It’s part of a more balanced market cycle.

Related Reading

Why Calgary Buyers Are Suddenly Getting More Leverage in 2026

Nobody Tells Calgary Sellers This — But It Matters More Than Staging

Conclusion

Buyer hesitation doesn’t mean your home won’t sell.

It means buyers are thinking more carefully — and sellers need to meet them there.

The homes that are selling right now aren’t perfect — they’re aligned.

If you’re selling (or planning to sell) and want help understanding what today’s Calgary buyers are hesitating on — and how to adjust without guessing — I’m happy to walk you through it.

📩 DM me “ADJUST” and we’ll talk through your next best move.

About Kristen Edmunds

Kristen Edmunds is a Calgary-area REALTOR® and Associate Broker with KIC Realty, specializing in acreages, luxury homes, and smart buy/sell strategies. With expertise in rural properties (water wells, septic, equestrian facilities) and a client-obsessed approach, Kristen helps buyers and sellers achieve their real estate goals with confidence and ease.