The Spring 2025 housing market update from CREB® confirms what many Calgary buyers and sellers are already experiencing—demand is red hot, and inventory is struggling to keep up. With price growth showing no signs of slowing and migration fueling competition, now more than ever, strategic real estate advice is crucial. Here's what you need to know.

1. Calgary’s Market Momentum Is Strong

Calgary remains one of Canada’s fastest-growing cities, with population growth projected to top one million households by 2046. This demand surge continues to push sales up in the face of limited listings, especially in the detached, row, and semi-detached sectors.

Sales rose 13% year-over-year in the first quarter of 2025.

New listings only increased by 9%, intensifying competition.

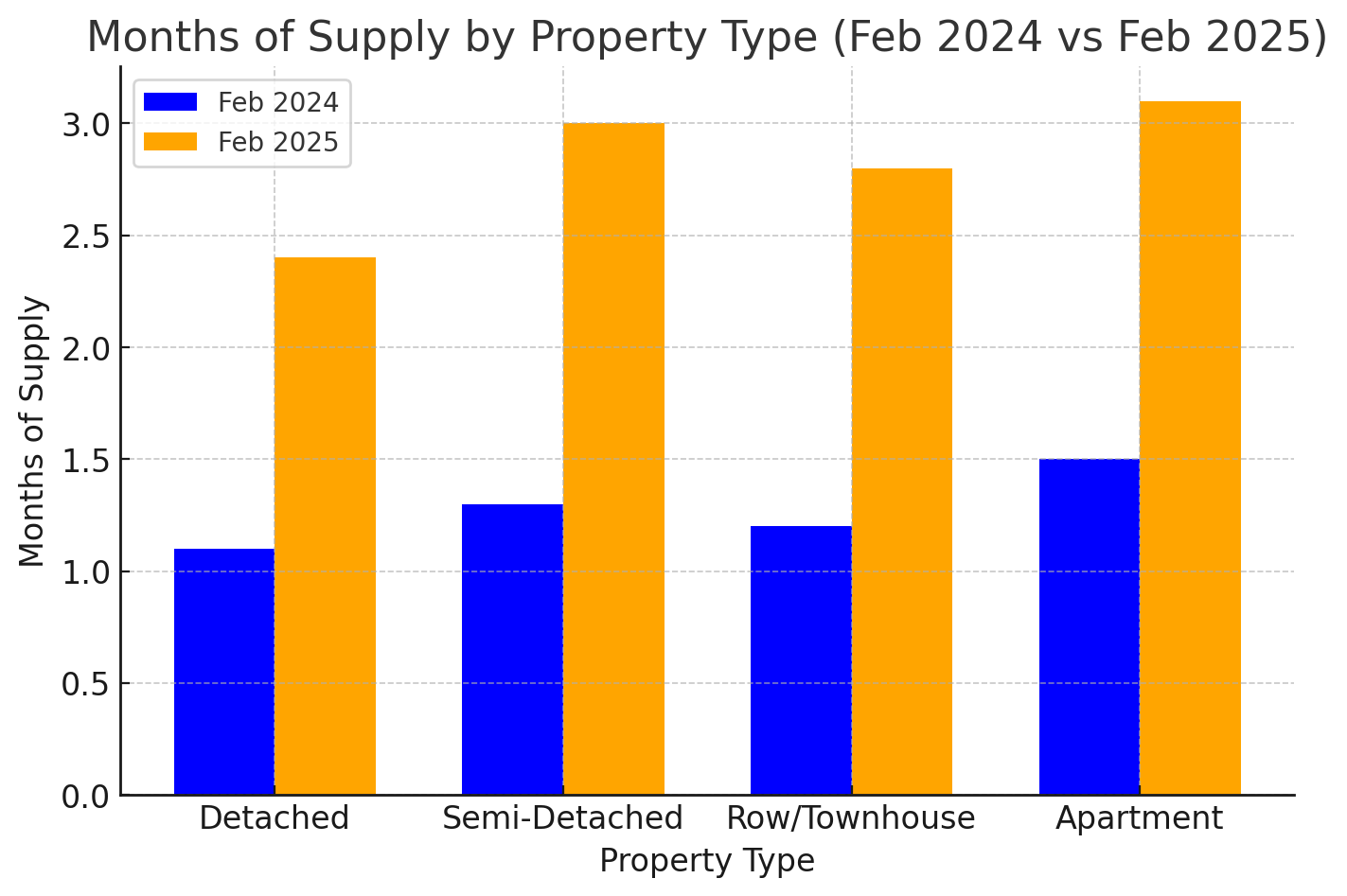

Months of supply remained below two, keeping conditions firmly in seller’s territory.

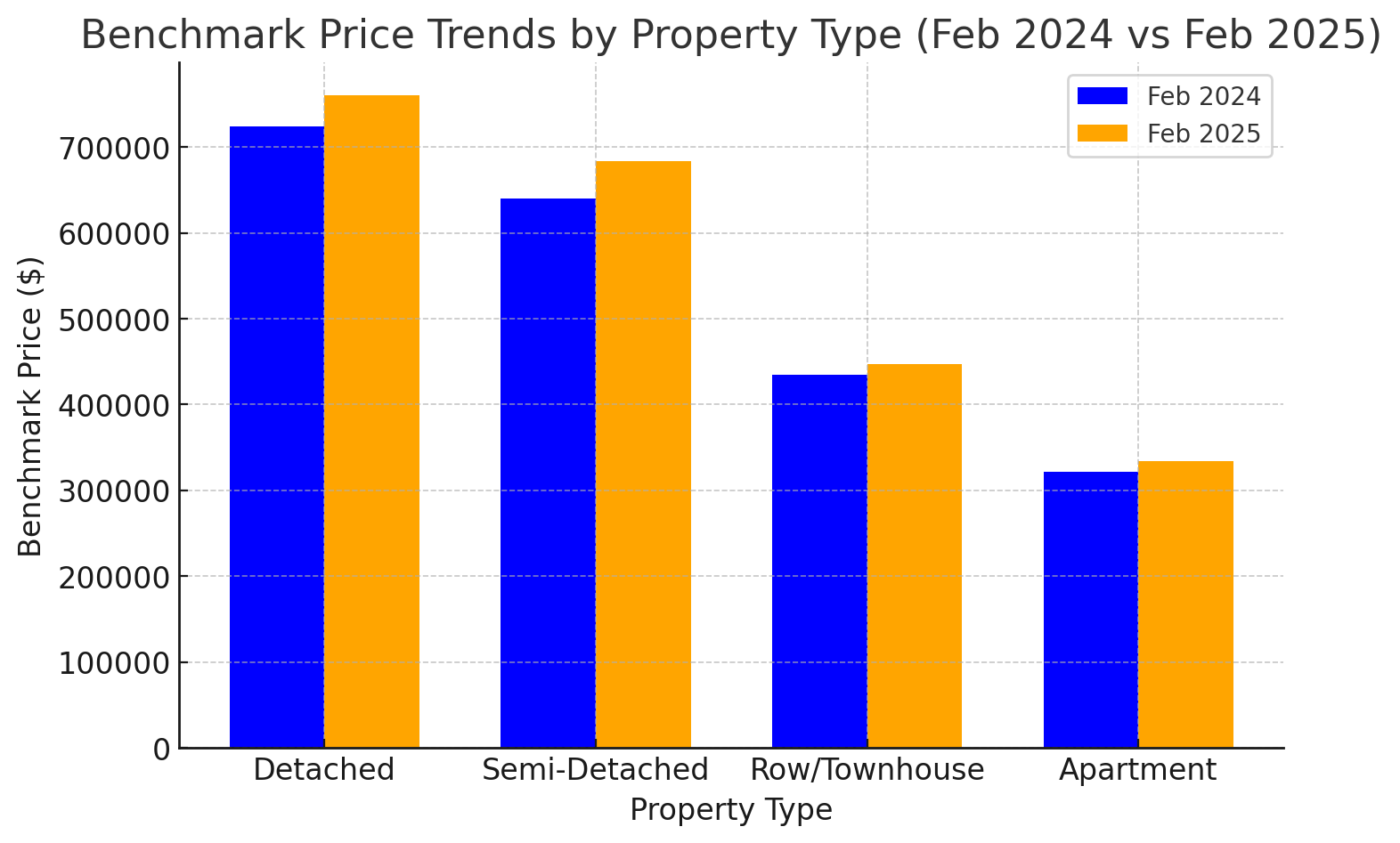

2. Price Growth Driven by Supply Constraints

Despite affordability advantages over cities like Toronto and Vancouver, Calgary is seeing record-breaking prices due to sustained low inventory. The benchmark price reached $580,700, a 9.6% year-over-year increase.

Detached homes: $717,100, up 12%.

Row homes: $447,900, up nearly 20%.

Apartments: $324,000, up 13%, but growth has cooled due to increased supply.

3. Regional Snapshot: Markets Near Calgary Stay Hot

The surrounding areas saw similar dynamics, with most regions reporting increased sales and price gains.

Airdrie: Sales rose 28%; inventory remains tight.

Cochrane: Prices up 11% year-over-year, led by detached homes.

Chestermere & Okotoks: Sales increased, though at a slower pace; semi-detached and row sectors are especially popular due to relative affordability.

4. Migration and Jobs Fuel Housing Pressure

Net migration remains a key market driver, bolstered by strong job growth. With unemployment dropping to 6.5% in Q1 2025, new Calgarians are quickly entering the home-buying market, particularly those seeking entry-level or mid-range properties.

5. What Buyers and Sellers Should Know This Spring

For Buyers: Expect ongoing competition, especially under $700K. Pre-approvals and flexible terms can help you move fast in multiple-offer scenarios.

For Sellers: Well-priced and well-presented homes are selling quickly. Strategic pricing is key to generating interest while maximizing returns.

For Investors: Row homes and duplexes remain strong performers with attractive rental yields and lower price points than detached properties.

Final Thoughts: Strategy Is Everything in Spring 2025

The Spring 2025 market offers opportunity—but only for those prepared to act quickly and strategically. Whether you're planning to buy, sell, or invest in Calgary or the surrounding areas, the current conditions demand expertise and guidance.

📩 Want a detailed breakdown of how these trends impact your specific property or neighborhood?

Contact Me Today!

Source CREB.com

Kristen Edmunds is a Calgary-area REALTOR® and Associate Broker with KIC Realty, specializing in acreages, luxury homes, and smart buy/sell strategies. With expertise in rural properties (water wells, septic, equestrian facilities) and a client-obsessed approach, Kristen helps buyers and sellers achieve their real estate goals with confidence and ease.