In January 2025, Calgary's housing market experienced notable shifts, with increased inventory levels and a slight moderation in sales activity. According to the Calgary Real Estate Board (CREB), inventory levels rose to 3,639 units, marking a 70% year-over-year increase. Despite this significant gain, inventories remain below the typical January levels of over 4,000 units. The rise in supply was primarily driven by a boost in new listings, which reached 2,896 units in January compared to 1,451 sales. This influx of new listings contributed to a months of supply figure of 2.5 months, an improvement from the one month reported last year, yet still considered low for a winter month.

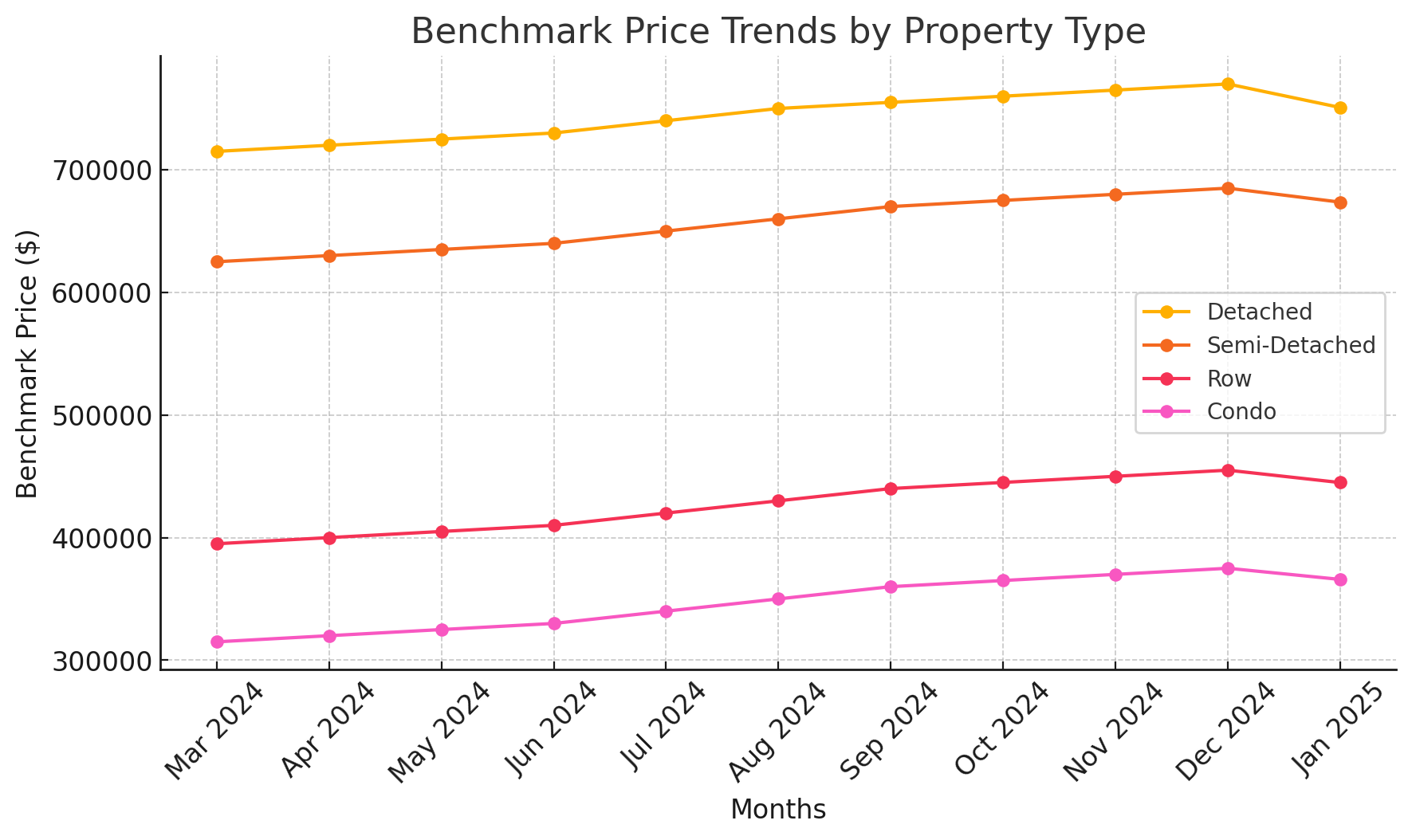

Sales activity in January saw a 12% decline compared to the same month last year, totaling 1,451 transactions. However, it's important to note that despite this decrease, sales levels remained nearly 30% higher than the typical figures recorded in January. The total residential benchmark price was reported at $583,000, which is relatively stable compared to the end of last year and nearly 3% higher than January 2024. Price growth varied across different districts and property types within the city.

Detached Homes

New listings for detached homes increased by 29% year-over-year, reaching 1,228 units in January. Sales activity in this segment slowed to 674 units, aligning with long-term trends. The improvement in new listings relative to sales supported inventory gains; however, the 1,448 units in inventory are still nearly 27% lower than typical January levels. The months of supply remained relatively low at just over two months. The unadjusted benchmark price for detached homes was $750,800, slightly higher than the previous month and 7% higher than January 2024.

Semi-Detached Homes

The semi-detached sector experienced gains in new listings relative to sales, leading to some increases in inventory levels. Sales in January improved over last year, keeping the months of supply just below two months. Notably, the City Centre, North East, and West districts reported near or above three months of supply, while other districts maintained less than two months. The unadjusted benchmark price was $673,600, slightly lower than the previous month but over 8% higher than January 2024. Districts with higher months of supply saw modest monthly price declines, while others experienced stable to modest gains.

Row Homes

In 2024, row home sales reached 4,647 units, a gain of over 2% compared to the previous year and the second-highest total on record. The growth in sales was facilitated by an 18% increase in new listings, particularly for homes priced above $400,000. This rise in new listings relative to sales supported inventory growth throughout 2024. By year-end, the improved supply helped alleviate some pressure on home prices. However, the annual benchmark price still rose by 14% as conditions favored sellers throughout the year. Price increases were observed across all city districts, ranging from 12% in the City Centre to over 20% in the North East and East districts.

Apartment Condominiums

January reported a boost in new listings compared to sales activity in the apartment condominium segment, causing inventory levels to rise to 589 units—more than double the near-record low levels reported last January. This increase brought inventories more in line with long-term trends. The months of supply also improved, pushing above two months, a trend that began in the second half of last year. While improving supply relative to sales has taken some pressure off home prices, this effect has not been consistent across the city. Citywide, the unadjusted benchmark price was $444,900, slightly lower than the previous month but nearly 5% higher than last year. The largest monthly adjustment occurred in the North East district.

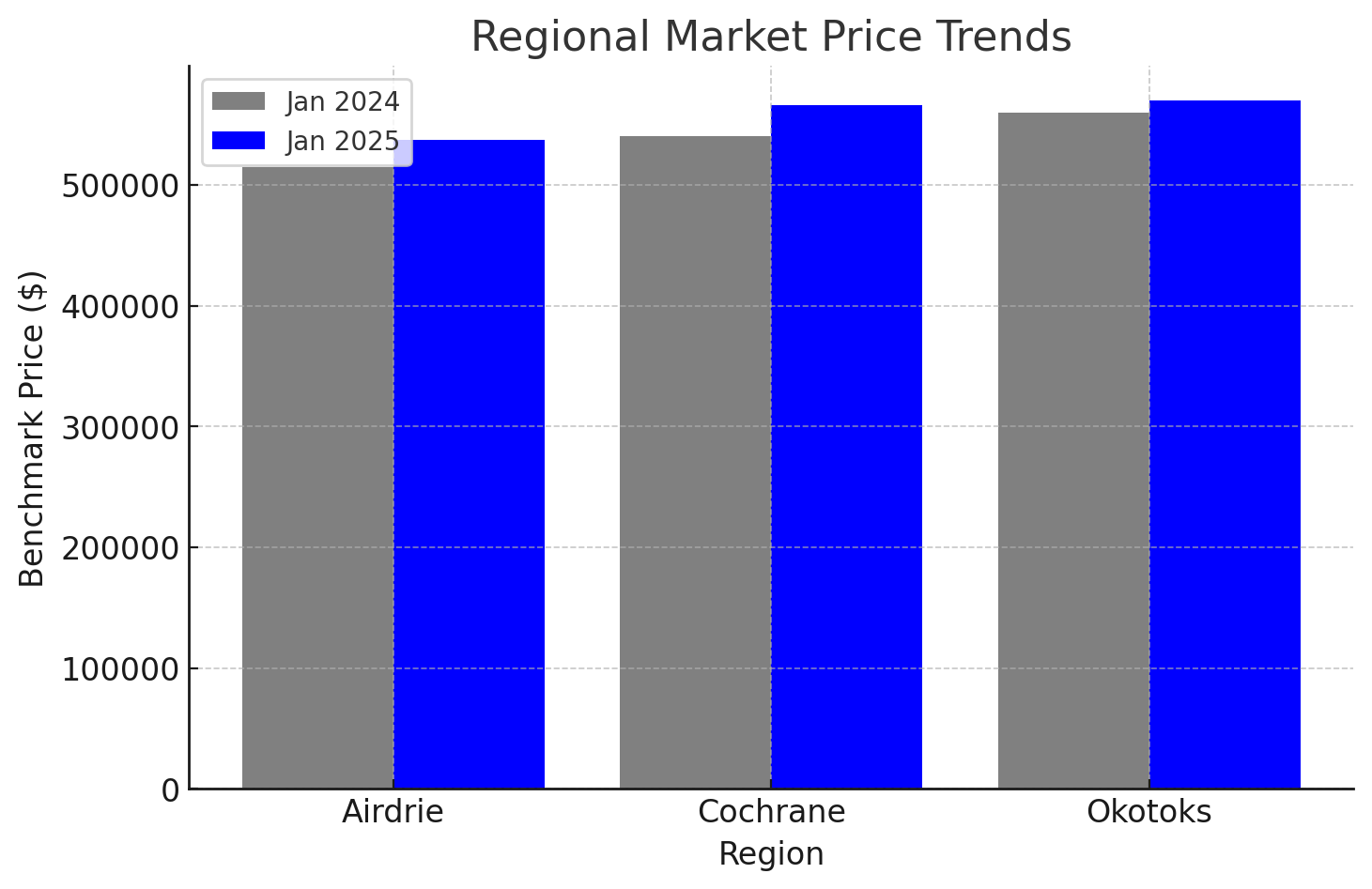

Regional Markets

Airdrie: Sales in January remained consistent with levels reported in the previous month and last year, both well above long-term trends. A boost in new listings led to improved inventory levels, with the months of supply remaining above two months for the fifth consecutive month. The unadjusted benchmark price was $537,300, down from the previous month but nearly 4% higher than last year.

Cochrane: Improved levels of new listings and inventories were observed, with 104 new listings in January compared to 71 sales, pushing inventories up to 156 units. While inventory levels are better than the past three years, they still fall short of long-term trends for January. The unadjusted benchmark price was $565,900, down from the previous month but nearly 5% higher than last January.

Okotoks: New listings remained relatively low compared to last year. While a pullback in sales supported some improvements in inventory levels, the 68 units available in January are still half the levels available in January prior to the pandemic. Limited supply has driven much of the price gains in this market since 2021.

Overall, Calgary's housing market in January 2025 is showing signs of moving toward more balanced conditions, with increased inventory levels and moderated sales activity. While prices have remained relatively stable, variations exist across different property types and districts within the city.

Source creb.com

Kristen Edmunds is a Calgary-area REALTOR® and Associate Broker with KIC Realty, specializing in acreages, luxury homes, and smart buy/sell strategies. With expertise in rural properties (water wells, septic, equestrian facilities) and a client-obsessed approach, Kristen helps buyers and sellers achieve their real estate goals with confidence and ease.